Board of Directors Requirements

1. The formation of GIG’s Board of Directors:

Pursuant to the decision of the Ordinary General Assembly of Gulf Insurance Group K.S.C.P. issued on 15 May 2023, it was approved to appoint and elect a new Board of Directors for the next three years. The Board of Directors was formed of individuals with extensive, diverse, and specialized experience, skills, and knowledge in the field of insurance, resulting in a balanced and positive form of the Board, enabling the Board to exercise its functions and responsibilities while considering the evolving business needs. On 28 July 2024, the resignation of some appointed and elected members was accepted, and new members were elected and appointed to represent the Board of Directors in its current session, as follows:

The GIG’s Board of Directors has a structure that is in proportion to the size and nature of the Group’s activities and the tasks and responsibilities assigned to its members. The Board was structured in a way that takes into consideration the diversity of its professionals and their practical experiences, in addition to technical skills.

The Nominations and Remuneration Committee verifies that the members of the Board of Directors and the Executive Management meet all the requirements of the relevant regulatory authorities and review the required skills for membership of the Board of Directors and the Executive Management, whenever necessary.

GIG’s Board of Directors consists of (6) members, (1) executive members, and (5) non‑executive members (of which (2) are independent members). All Board members are professionals with a proven record of Board membership in various other companies; they have the necessary skills for their positions, in addition to the experience and knowledge of the insurance industry. All Board members are elected or appointed by representation through the General Assembly every three years, and the members have been re‑elected and appointed in 2023 and 2024.

Mr. Khosrowshahi was born in 1961; he obtained his Bachelor’s degree in 1983 and Master’s degree in 1986 in Mechanical Engineering from Drexel University (USA). Mr. Bijan currently holds the position of Chairman and Chief Executive Officer of Fairfax International (London) and a Board Member representing Fairfax Financial Holding Limited in the following companies: Gulf Insurance Group (Kuwait), Gulf Insurance and Reinsurance Company (Kuwait), Bahrain Kuwait Insurance Company (Bahrain), Arab Misr Insurance Group (Egypt), Commercial International Bank (Egypt), Arab Orient Insurance Company (Jordan), Jordan Kuwait Bank (Jordan), Alliance Insurance Company (Dubai), and BRITA Limited (UK). Colonnade Insurance S.A. ‑ Luxembourg, Southridge General Insurance Company S.A. ‑ Chile, La Meridional Company Argentina de Seguros S.A. ‑ Argentina, Sebas Seguros Colombia S.A. ‑ Colombia.

Mr. Bijan Khosrowshahi previously held the position of President and CEO, at Fuji Fire and Marine Insurance Company – in Japan, President of AIG’s General Insurance operations – in Seoul, Korea (2001–2004), Vice Chairman and Managing Director, at AIG Sigorta – Istanbul, Turkey (1997–2001), Regional Vice President, AIG’s domestic property and casualty operations for the MidAtlantic region – USA, and held various underwriting and management positions with increasing responsibilities, AIG, USA since 1986, Board Member, Foreign Affairs Council, Board Member, Insurance Society of Philadelphia, Council member, USO, Korea, Chairman, Insurance committee of the American Chamber of Commerce, Korea, Member, Turkish Businessmen’s Association.

Mr. Al Hasan holds a Bachelor’s degree in Political Science and Economics from Kuwait University (1976). His professional Insurance and Administrative experience exceeds over 40 years in different Executive positions. He joined Gulf Insurance in 1978. He is currently the Vice Chairman and CEO of GIG, and the Chairman of Kuwait Insurance Federation “KIF” (Kuwait). He is on the Board of Directors in many of Gulf Insurance Group subsidiaries, General Arab Insurance Federation “GAIF” (Egypt) and the Arab Reinsurance Company (Lebanon).

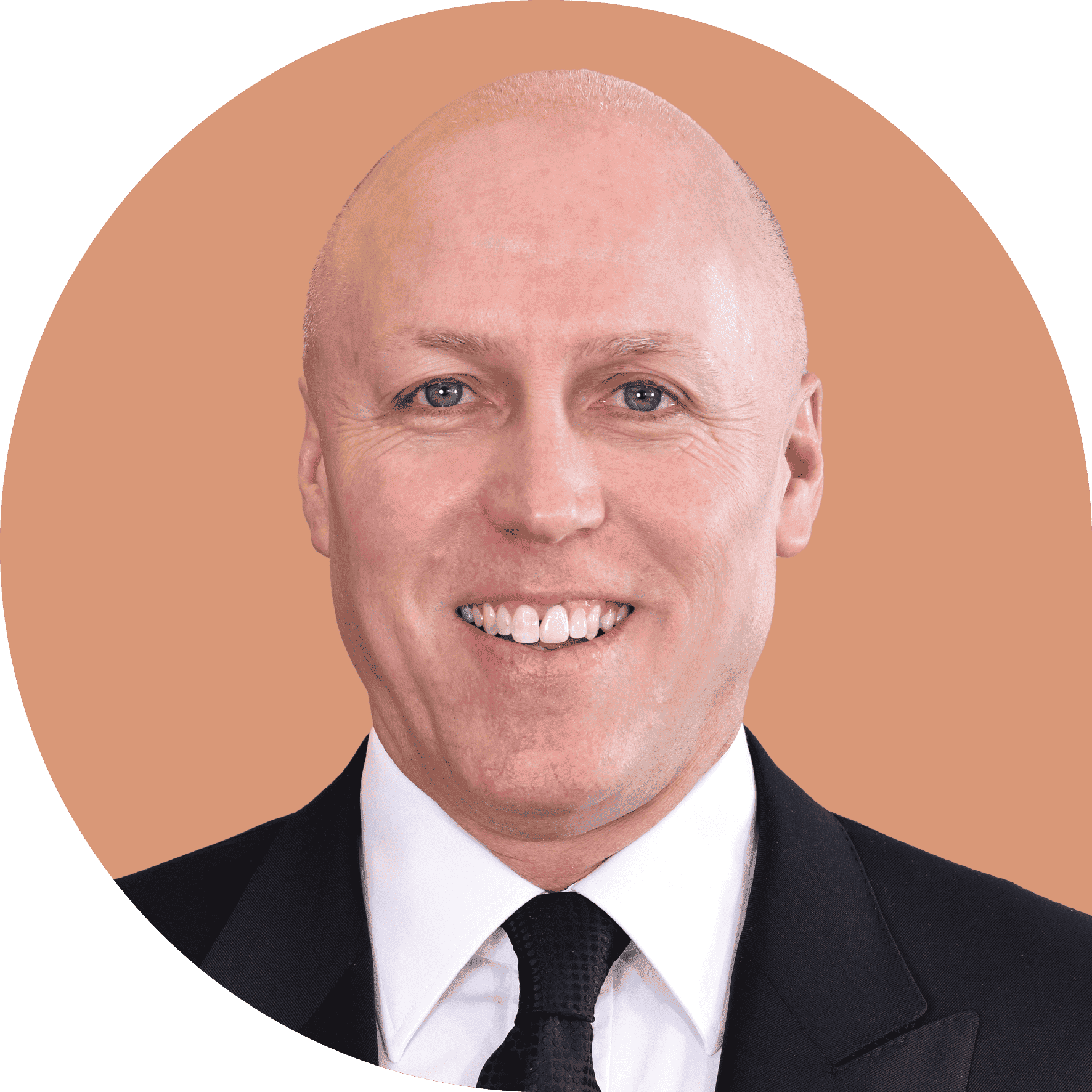

Mr. Cloutier received his Bachelor’s degree in Actuarial Sciences from Laval University in 1986. He is a fellow of the Casualty Actuarial Society and a member of the Canadian Institute of Actuaries. Mr. Cloutier joined Fairfax in 1999 as Vice President and Chief Actuary, becoming Vice President of International Operations in 2009, and is Chairman of Fairfax International from 2013 to the present. From 1990–1999, he was Vice President of Actuarial Services of Lombard Canada Limited, a Canadian property and casualty insurance company, Mr. Cloutier serves on the Board of several Fairfax Subsidiaries as well as Industry Organizations on behalf of Fairfax.

Robert Quinn McLean is a Vice President at Hamblin Watsa Investment Counsel, a wholly owned subsidiary of Fairfax Financial. He is responsible for the Fairfax insurance subsidiary investment portfolios in the Middle East/ Turkey/North Africa (Gulf Insurance Group) and South Africa/Botswana (Bryte Insurance). Mr. McLean is currently on the board of Gulf Insurance Group based in Kuwait, Farmers Edge Inc. (Winnipeg, Canada), Boat Rocker Media Inc. (Toronto, Canada), and Helios Fairfax Partners Corporation (Toronto, Canada). Initial work experience was in the public accounting profession including work in audit and tax. Subsequently, Mr. McLean entered the investment management profession as an investment analyst working for an Institutional Investment Manager in Toronto, Canada focusing on international equities (Europe and Asia). He is a Chartered Accountant (CA, CPA) and Chartered Financial Analyst (CFA designation).

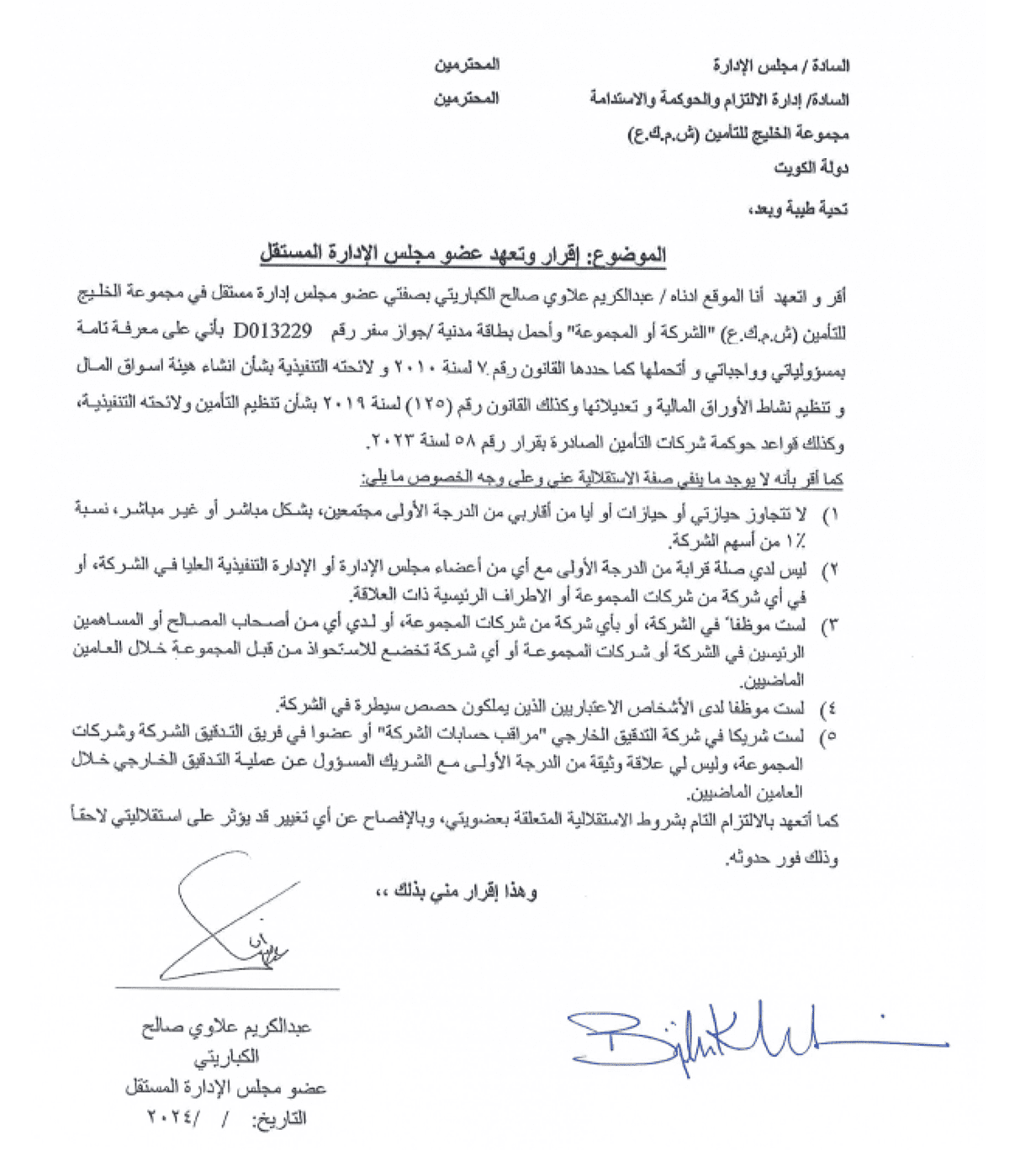

Abdulkarim Kabariti is a prominent leader with extensive experience in the banking, economic, and political fields. He has held several leadership positions in Jordanian governments, in addition to his active role in the financial and investment sectors at the regional and international levels. Kabariti holds a Bachelor’s degree in Business Administration and Financial Management with honors from St. Edward’s University, USA. He also holds an honorary doctorate in Business Administration from Coventry University, UK.

Currently, he holds several prominent positions, including:

- Chairman of the Board of Directors ‑ Gulf Bank Algeria

- Vice Chairman of the Board of Directors ‑ Burgan Bank Türkiye

- Member of the Board of Directors – Burgan Bank (Kuwait), Bank of Baghdad, Gulf Insurance Group, and Jordanian Dairy Company.

- Chairman of the Board of Trustees ‑ Al‑Ahliyya Amman University

Previously, he held several prestigious positions, including:

- Prime Minister and Minister of Foreign Affairs and Defense of Jordan (1996–1997)

- Chief of the Royal Hashemite Court (1999–2000)

- Member of the Jordanian Senate and First Deputy President of the Senate

- Chairman of the Board of Directors of the Jordan Kuwait Bank (1997–2021)

Thanks to his strategic vision and profound experience, Kabariti contributed to developing economic policies, enhancing the investment environment, and leading major financial institutions, making him one of the influential figures in the region.

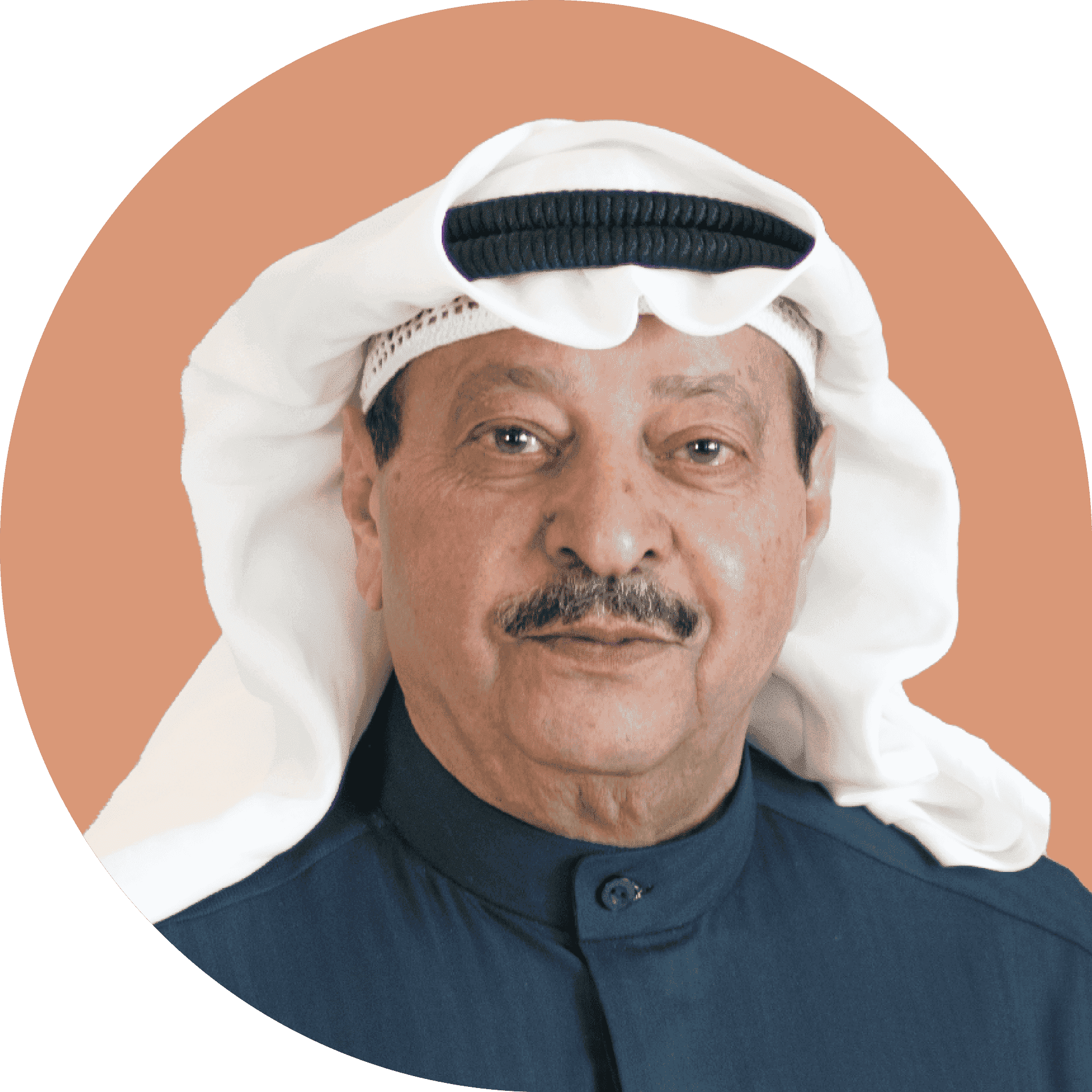

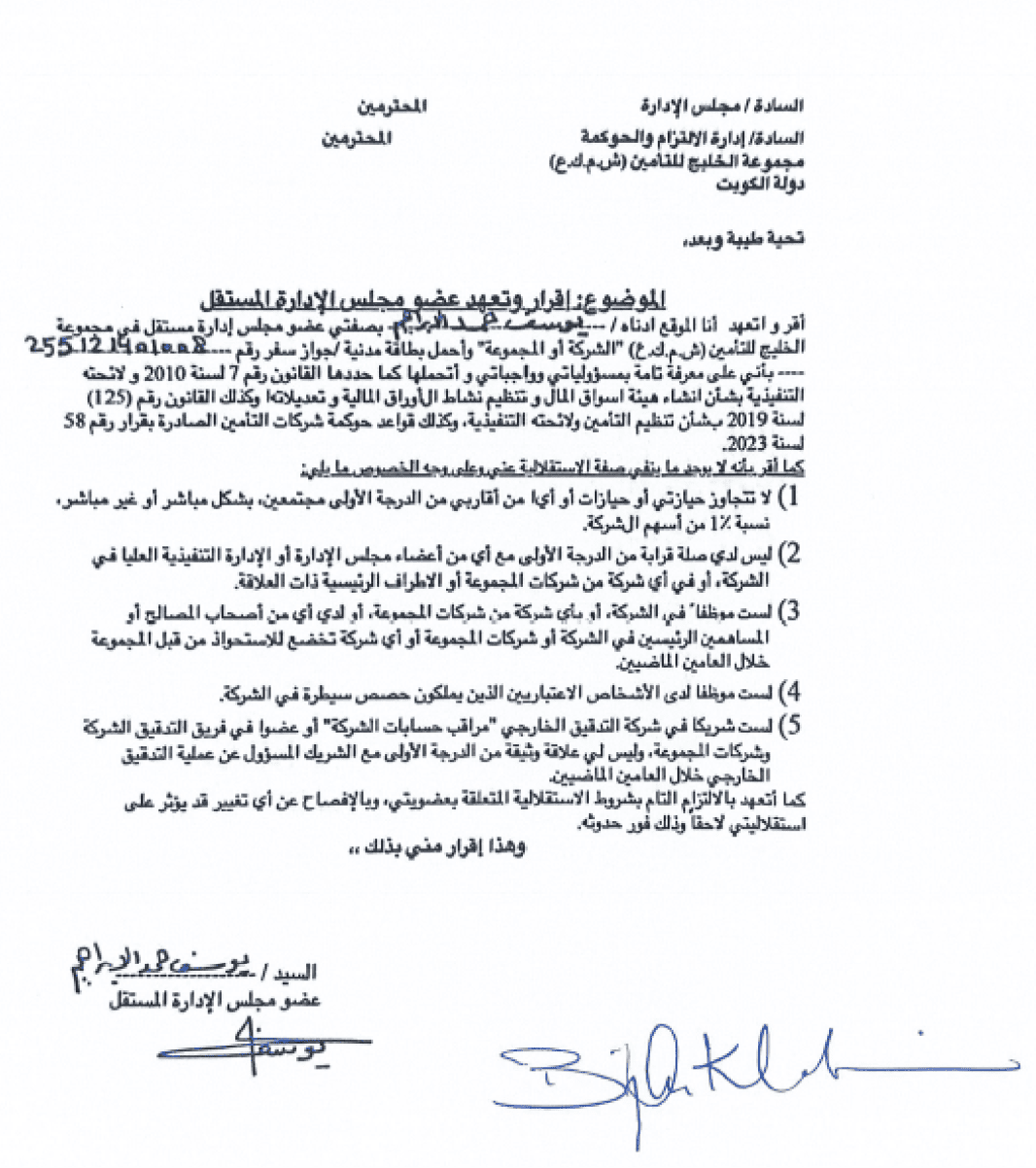

Dr. Yousef Hamad Al‑Ebrahim has a distinguished career in academia, public service, and the private sector, having held several ministerial, academic, and leadership positions in major institutions. He holds a PhD in economics from Claremont Graduate University, USA, and has published numerous books, reports, and research papers.

Currently, he holds several prominent positions, including:

- Chairman of the Board of Directors – Investcorp

- Member of the Board of Trustees and Executive Committee – Arab Open University

- Chairman of the Audit Committee – Arab Open University

- Member of the Board of Trustees – Hamad Bin Khalifa University, Qatar

- Member of the Board of Trustees – Economic Research Forum (ERF)

Previously, he held several prestigious positions, including:

- Minister of Finance, Minister of Planning, and Minister of State for Administrative Development Affairs‑ Kuwait

- Minister of Education and Minister of Higher Education‑ Kuwait

- Economic Advisor at the Amiri Diwan with the rank of Minister‑ until February 2021

- Dean of the College of Business Administration ‑ Kuwait University

- Cultural Counselor‑ Cultural Office, Embassy of Kuwait in Washington

- Member of the Supreme Council for Planning and Development, chaired by His Highness the Prime Minister

- Member of the Board of Directors of the Kuwait Foundation for the Advancement of Sciences (KFAS), chaired by His Highness the Amir of Kuwait

- Member of the Board of Trustees of the Kuwait Institute for Medical Specializations (KIMS)

- Member of the Board of Directors of the Arab Gulf States Institute in Washington (AGSIW)

- Member of the Advisory Board of the Center for Contemporary Arab Studies ‑ Georgetown University, USA

- Chairman and Member of the Board of Directors of the Gulf Investment Corporation

- Vice Chairman of the Board of Directors of Al‑Mal Investment Company

- Member of the Boards of Directors of several non‑governmental organizations, such as the Kuwait‑American Alliance and INJAZ Kuwait in cooperation with Junior Achievement International

Dr. Al‑Ebraheem is distinguished by his strategic vision and extensive experience in economics, planning, and development, making him one of the prominent leadership figures in the region.

Mr. Rami Selim Al Baraki holds a Bachelor’s Degree in Commerce in Accounting from Mansoura University, Egypt. He is responsible for the Group’s consolidated financial statements applying the Group’s accounting policies and implementing international accounting standards. In addition, he takes care of GIG’s Capital Structure, Treasury, investment reporting, and Takaful Unit Operations and recommends to the Board the Capital Structure type that the Company needs to have for both short‑term (working Capital) and long‑term purposes (capital investments) in line with GIG’s plans for future acquisitions and expansions. Mr. Al Baraki is also the Group Secretary of the Board and a member of the Board of Directors of GIG Egypt and Gulf Takaful Insurance Co.

2. Brief on the ownership structure of major shareholders

3. Statement and overview of the Board of Directors meetings

The Board meetings are held in the presence of the majority of its members. During the financial year ended 31 December 2024, (12) Board meetings were held. The Board meeting is held upon the invitation of the Chairman, and the invitation and agenda are sent at least three working days before the set date so that the Board members are given sufficient time to study the topics raised and make appropriate decisions.

The following table shows an overview of the Board of Directors meetings:

3.1 Statement on the Ordinary and Extraordinary General Assembly Meetings

3.2 The most important decisions and achievements of the Board of Directors

The Board of Directors accomplished several achievements during the year ended on 31 December 2024. The most prominent of these achievements include, but are not limited to, the following:

- Reviewing and discussing the Group’s objectives, strategies, plans, and policies.

- Approving the estimated annual budget as well as the quarterly and annual financial statements.

- Implementing the corporate governance system and monitoring the effectiveness of its implementation in accordance with the Insurance Regulatory Unit Law.

- Following up and supervising the performance of the Executive Management team.

- Regularly ensuring the effectiveness of internal controls and the general framework for risk management.

- Ensuring the achievement of the best financial and technical results, which positively impact the rights of shareholders and policyholders.

4. Independent Board Members

Gulf Insurance Group views the independence of board members as an essential feature of sound corporate governance. GIG’s independence standards are in line with laws and reflect the best applications, including, for example, Decision No. (58) of 2023 regarding the issuance of insurance company governance rules issued by the Insurance Regulatory Unit.

Accordingly, the Board of Directors includes non‑executive members and members who are independent of the management. In addition, the Nominations and Remuneration Committee periodically reviews the independence of the Board members and verifies the lack of independence in accordance with the Group’s Conditions of Independence guidelines, approved by the Board of Directors and in line with regulatory requirements.

Board of Directors Committees

5. Brief on the implementation of the requirements for the Board of Directors to form specialized, independent committees

Committees are formed and their members are appointed by the Board of Directors after each election session of the Board. The committees emanating from the Board are considered links between the Executive Management and the Board of Directors. The purpose of forming these committees is to enable the Board to perform its duties effectively.

GIG’s Board of Directors has five main committees, as follows:

- Audit Committee (the date of formation and selection of the members of the Audit Committee is 15 May 2024. The term of the Committee is three years from the date of formation, to be consistent with the Board’s term of office).

- Risk Management Committee (the date of formation and selection of members of the Risk Management Committee is 15 May 2024. The term of the Committee is three years from the date of formation, to be consistent with the Board’s term of office).

- Nominations and Remuneration Committee (the date of formation and selection of members of the Nominations and Remuneration Committee is 15 May 2024. The terms of the Committee are three years from the date of formation, to be consistent with the Board’s term of office).

- Executive and Investment Committee (the date of formation and selection of members of the Executive and Investment Committee is 15 May 2024. The term of the Committee is three years from the date of formation, to be consistent with the Board’s term of office).

The Group’s Board of Directors has approved the rules and regulations for the work of all committees, which include defining the tasks of each committee, its term of work, the powers granted to it during this period, and how the Board of Directors supervises it in a specific work charter for each committee. The tasks and powers of the committees have also been defined, in addition to the committees being delegated their powers by the Board of Directors.

5.1 Audit Committee

The Group is certain that the existence of an independent Audit Committee is a key factor in applying proper corporate governance rules. The Audit Committee ensures the consolidation of the commitment culture within the Group; this is achieved by ensuring the soundness and integrity of the Group’s financial statements, in addition to ensuring the scope and effectiveness of the internal control systems applied within the Group.

The Audit Committee at Gulf Insurance Group enjoys full independence, in addition to this, all its members have specialized expertise that fully supports the committee’s performance of its duties.

The Audit Committee consists of three members: an executive member, a non‑executive member, and the third an independent member. The chairman is a non‑executive board member. The Group’s Internal Audit senior manager attends the meetings, in addition to a representative of the external auditor who attends the committee meetings periodically.

The Audit Committee oversees the audit matters on behalf of the Board; therefore, the committee has a responsibility to ensure that the internal audit is being conducted with proper professionalism and that its scope of work is appropriate.

Audit Committee meetings are held taking into account the time consideration of the issuance of the Group financial reports to the external parties, and the meetings are held not less than four times a year.

5.1.1 Number of Audit Committee meetings during 2024

Meetings are held regularly and as needed so that the Committee meets at least twice a year.

The committee held 5 meetings during the year 2024 as follows:

5.1.2 Brief on the most prominent decisions and achievements issued by the Audit Committee during 2024, including but not limited to:

- Reviewed and discussed the interim and annual financial statements to ensure their soundness and integrity and submit them to the Board of Directors for approval.

- Made recommendations to the Board on the appointment of external auditors and monitored their performance.

- Studying the accounting policies adopted and expressed an opinion and made recommendations to the Board of Directors regarding them.

- Ensured the adequacy and effectiveness of the internal control systems applicable within the group and prepared a report in this regard.

- Reviewed internal audit reports and made recommendations.

- Review and discuss the internal audit plan for the current year.

- Ensured the group’s compliance with related laws, policies, systems, and instructions and reviewed the reports of the regulatory authorities.

- The Committee also reviewed the report of the Independent Audit Office, which reviews the quality of internal audit work in the Group every three years, in accordance with the Authority’s instructions in this regard. The Office submitted its report, and its technical opinion indicated that the management adheres to international internal audit standards, best professional practices, and the use of automated solutions in management operations.

- During the year 2024, the Audit Committee assessed the adequacy of the internal control systems applied by the company, and the committee concluded that the applied internal control systems are sufficient to verify the impact of the risks to which the company is exposed.

- The Audit Committee did not encounter any challenges or obstacles.

5.2 Risk Management Committee

The GIG Risk Management Committee sets policies and regulations for risk management in a manner consistent with the Group’s risk appetite.

The Audit Committee consists of three members: an executive member, a non‑executive member, and an independent member. Its chairman is a non‑executive board member.

5.2.1 Number of Risk Management Committee meetings during 2024

The Risk Management Committee holds periodic meetings, at least four times a year, and whenever necessary, and the minutes of its meetings are recorded.

The committee held 4 meetings during the year 2024 as follows:

5.2.2 Brief on the most prominent decisions issued by the Risk Management Committee during 2024, including but not limited to:

- The primary objective of the Risk Committee is to assist the Board of Directors in setting appropriate strategies and objectives for risk management and to make recommendations consistent with the nature and scale of the Group’s activities.

- During the year 2024, the committee held four meetings, all remotely, to oversee the latest risk management activities, monitor performance, review the group’s expansion strategies, and approve key risk mitigation plans.

- The Committee closely monitored the Group’s key risk indicators, the credit rating, and the potential impact of the acquisitions made by the Group on its capital adequacy and liquidity ratios, including the new IFRS 17 indicators.

- The Committee reviewed proposals to exit some investments according to the group’s strategy, including reviewing risk assessment reports. The decision to exit from these investments was approved and the recommendation was submitted to the Board of Directors for approval.

- The Committee reviewed the Group’s key risks quarterly and made recommendations to the Risk Management Department and Executive Management when necessary.

- The Committee approved the cybersecurity governance framework and submitted it to the Board of Directors for approval.

- The Risk Management Committee did not encounter any challenges or obstacles.

5.4 Nominations and Remunerations Committee

The availability of professional experience and technical skills, as well as the personal qualities and ethical standards of the nominated persons for membership in the Board of Directors or Executive Management, are considered the main cornerstones for the Group’s financial stability and are an important aspect of risk prevention. Additionally, the equitable allocation of remuneration attracts highly qualified and technical labor, as well as strengthening the concept of loyalty to the Group and accordingly maintaining qualified labor. It further motivates employees across all levels to achieve the Group’s objectives and improve the Group’s performance.

The Nominations and Remuneration Committee consists of three members: a non‑executive member, an executive board member, and its chairman, who is an independent board member.

5.4.1 Number of Nominations and Remuneration Committee Meetings During 2024

The Risk Management Committee holds periodic meetings, at least once a year, and whenever necessary, and records the minutes of its meetings.

The committee held meetings during the year 2024 as follows:

5.4.2 Brief on the Nominations and Remuneration Committee achievements during 2024, including but not limited to:

During 2024, the Nominations and Remuneration Committee provided many effective recommendations to establish a solid corporate governance framework within the group’s entities, including but not limited to the following:

- Ensured the independence of the independent board members.

- Recommended the approval of the detailed annual report structure for all remunerations given to the members of the Board of Directors and Executive Management.

- Reviewed the requirements for appropriate skills for membership in the Board of Directors and executive management.

- Reviewed the conducted evaluation of the members of the Board of Directors, Executive Management, and the Board’s committees and submitted recommendations (if any) to the Board of Directors for approval.

- Reviewed the updates made to the remuneration policy and ratios regarding the updated policy and recommended them to the Board of Directors for approval.

- Reviewed the nomination applications submitted for membership in the group’s Board of Directors.

- The Nominations and Remuneration Committee did not encounter any challenges or obstacles.

5.5 Executive and Investment Committee

The Board has delegated the following responsibilities to the Committee which holds its meetings regularly and whenever necessary. The Committee consists of five members: The Chairman, the Vice Chairman, the Chief Executive Officer, and two members of the Board of Directors.

5.5.1 Number of Executive and Investment Committee meetings during 2024

The committee held (4) meetings during the year 2024, as follows:

5.5.2 Brief on the Executive and Investment Committee’s achievements during the year 2024, including but not limited to:

- Developed and proposed strategic plans that reflect the long‑term objectives and priorities of the Group.

- Followed up and monitored the implementation of strategies and policies approved by the Board of Directors.

- Monitored the efficiency and quality of the investment process compared to the objectives.

- Monitored market shares, growth, and penetration rates.

- Monitored the overall position and performance of the Group’s investments, as well as strategic investments, including investments in subsidiaries and associates.

- Monitored and reviewed the movements of the investment portfolio.

- Monitored the efficiency and quality of the investment process in comparison with the objectives.

5. Letter from the Board of Directors on the appointment of the Secretary of the Board

The Group has a Board Secretary appointed by the decision of the Board of Directors at the Board meeting held on 15 May 2023. There are clear regulations regarding the duties and responsibilities of the Board Secretary, approved by the Board of Directors and consistent with the requirements of the Insurance Companies Governance Rules.

6. An Overview of the structure of the Gulf Insurance Group

The Board has harnessed all its expertise to raise the level of the Group’s performance to be consistent with the aspirations of shareholders, stakeholders, and insurance policyholders. We have kept pace with governance frameworks to ensure the effectiveness of the Board of Directors and qualify its members to carry out their responsibilities towards key issues, as well as to encourage and facilitate their positive contributions. The Board has used committees affiliated with it to assign some tasks and responsibilities to them so that each committee submits its reports and recommendations periodically to the Board of Directors out of responsibility and transparency. The following figures show the Group’s corporate governance structure following the regulatory requirements regarding corporate governance:

5. Names of top executive management and executive directors

Mr. Farid Joseph Saber is the Group Chief Operations Officer of GIG. Mr. Saber has a Bachelor of Laws (LL.B.) and a bachelor’s in business administration from the Lebanese University in Beirut and a Diploma in Insurance (Dip CII).

Mr. Saber is an experienced Executive Officer with a demonstrated history of working in the insurance industry in the MENA region. He is also a Member of the Board of Directors at GIG Algeria, L’Algerienne vie (AGLIC), Gulf Sigorta, GIG Kuwait Takaful, GIG Egypt Life Takaful, all subsidiaries of GIG.

Mr. Osama Kishk joined the group in June 2017 as Group Chief Financial Officer. He is responsible for providing leadership and strategic direction to the group’s finance, financial planning & Analysis, Treasury and investment, and merger and acquisition functions and for the integrity and flow of the financial information to the management, the board, shareholders and financial institutions. He also works with the CEO in all financial matters at the group level and its subsidiaries. Mr. Kishk holds an MBA from Maastricht School of Management (MSM) in addition to several professional qualifications from the USA such as Certified Public Accountant (CPA), Certified Risk Professional (CRP), Certified Internal Auditor (CIA), and Certified Associate Business Manager (CABM). Mr. Kishk has over 29 years of experience in Finance, Accounting, Treasury, Investment and Auditing‑related fields.

Mr. Alsanousi holds a Bachelor of Science in Business Administration from the University of National and World Economy in Sofia, Bulgaria. He started his career as a Diplomat, eventually moving to the commercial world in 2004. In 2008, He joined Gulf Insurance as the Head of Marketing & PR. He played a vital role in transforming the department into what is now known as Group Corporate Communications, Investor Relations & Admin. Affairs. in which he pioneered the GIG brand and unified it across all Group companies in the MENA region. As a strategic leader, by overseeing Group Investor Relations, Mr. Sanousi practices transparency ensuring consistent messaging and efficiency in the Group’s relationship with its investors and other stakeholders. He is actively involved in creating opportunities in which the Group can benefit in the communities it operates in through well‑defined CSR strategies. He is also a member of ESG committee to establish and implement Corporate Sustainability framework at the Group to leverage its strategic priorities. Mr. Alsanousi also heads and manages the Group Admin. functions and instrumental in establishing sustainable procurement practices.

Mr. Mohamed Ibrahim has been with the group since 2011 and currently serves as the Head of the Assurance and Advisory sector. In this capacity, he is responsible for overseeing key group functions including Assurance, Compliance, Corporate Governance, Digital Assurance, Anti‑Financial Crime, and ESG initiatives, ensuring their alignment with the group’s strategic objectives.

Mr. Ibrahim plays an integral role in leading and facilitating the execution of several key projects, ensuring they are effectively implemented in line with the group’s goals. His project management expertise supports the successful delivery of complex initiatives across various business units.

He has made significant contributions to the digital transformation of the assurance and control functions, particularly through the automation of internal audit and assurance processes. By leveraging advanced digital platforms, he has enhanced operational efficiency and fostered greater integration across assurance functions.

Mr. Ibrahim is also committed to talent development within the assurance and advisory functions. He focuses on fostering professional growth, ensuring that team members have access to opportunities for skill enhancement to meet the evolving demands of the group.

He holds a bachelor’s degree in commerce, with a specialization in accounting, from Cairo University. Mr. Ibrahim is a member of the Institute of Internal Auditors (USA) and the Association of Certified Fraud Examiners (USA) and has earned the International Certificate in Compliance with distinction from the International Compliance Association.

Mr. Ahmed Ragab is a graduate with Honors in Actuarial Science from Cairo University – Egypt and is an Associate Actuary (ACIA) from the Canadian Institute of Actuaries – Canada. Additionally, he earned the designation of International Certified Valuation Specialist (ICVS) from the IACVA Institute – Middle East in 2014. During 2018, he worked at Fairfax – Canada as Actuarial Analyst for evaluating subsidiaries’ reserves, analyzing the operational performance, supporting the actuarial pricing team and streamlining various actuarial processes. In 2021, he was awarded the “Corporate Risk Manager of the Year” by the Middle East Insurance Industry Awards (MIIA). Mr. Ragab is also a Risk Committee member in L’Algérienne des Assurances “2A” – Algeria.

As the Chief Actuarial Officer, he is responsible for managing the Group’s technical portfolio to maximize the long‑term value of our insurance business and building internal capabilities in line with actuarial best practices. Besides, he is leading the implementation of centralized actuarial systems for enhanced integration across the Group as well as the Group Data Analytics endeavors. Mr. Ragab and his team play a vital strategic role in strengthening the in‑house actuarial functions and data science teams for operational excellence across the region.

9.1 Brief on how to apply the requirements for recording, coordinating, and keeping minutes of Board of Directors meetings

The Group has a special register in which the minutes of the Board of Directors meetings are recorded, with consecutive numbers for the year in which the meeting was held, indicating the place, date, and time of the meeting. In addition, minutes of discussions and deliberations, including the voting processes that took place, are prepared, categorized, and kept for easy reference.

9.2 Brief on the mechanisms that allow Board members to obtain accurate and timely information and data

Gulf Insurance Group has an effective and clear mechanism for providing complete, accurate, and timely information and data to all Board members in general and to non‑executive and independent Board members in particular.

The Group also pays great attention to developing its information technology infrastructure, particularly reporting, to ensure the quality and accuracy of information. The availability of timely and accurate information is a key element in assisting the Board of Directors in making the necessary decisions.